Financial KPIs and Dashboards That Matter for Independent Medical Practices

Financial KPIs and Dashboards That Matter for Independent Medical Practices

January 20, 2021

Providing the highest level of care for your patients is your number one goal. However, if you don’t show the same amount of consideration for financial health, you can quickly find yourself out of business. That’s a lesson that has been of particular importance in light of the crushing effects the COVID-19 pandemic has had on private practices. In fact, by August 2020 alone, just five short months into lockdowns, a survey conducted on behalf of ‘The Physicians Foundation’ found that 8% or 16,000 private practices had closed their doors due to the virus’ financial impact.

The good news is that even during rocky financial times, there are ways to protect your practice’s health, visualize trends that tell you how well your practice meets your business goals, and even discover revenue-generating opportunities.

It all begins with business analytics.

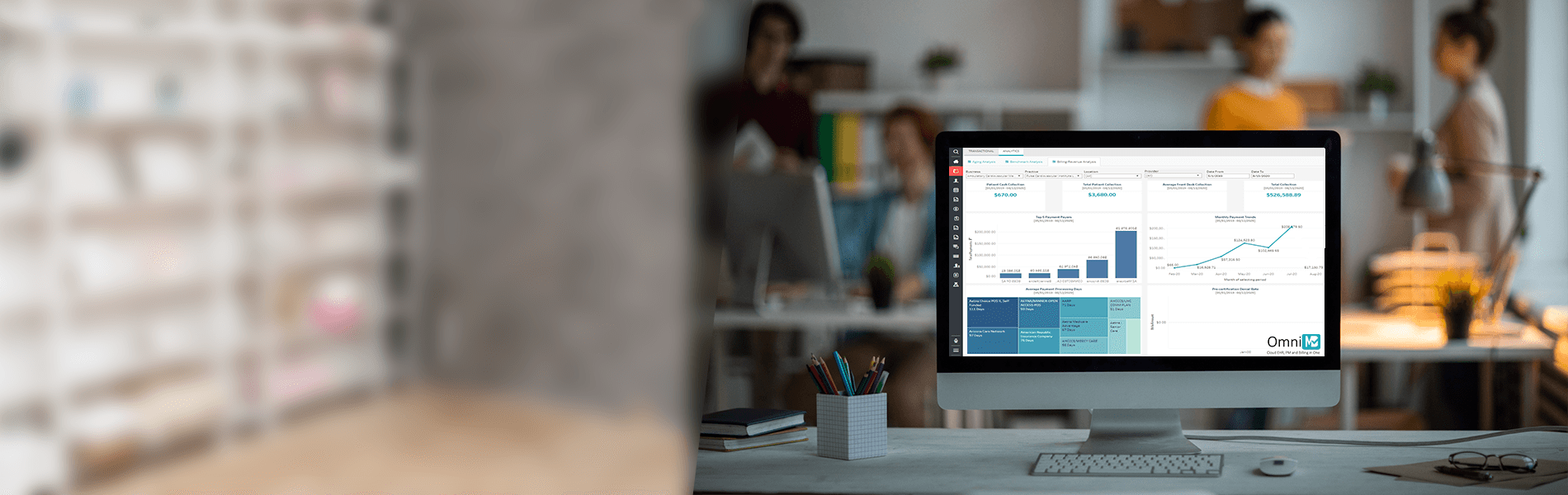

Keeping track of the Key Performance Indicators (KPIs) that matter the most for your independent practice allows you to accurately report, benchmark, and analyze outcomes and performance for value-based care. By measuring your success, you’re able to make the strategic decisions necessary to improve performance, grow your practice, and maximize your revenue.

The Most Valuable KPIs for Independent Medical Practices

To combine clinical, operational, and statistical data/trending to get the best picture of your practice’s financial health, a handful of the KPIs you should be tracking right now include:

- Accounts Receivable

The money owed to your practice by either patients or payers has a time value that can’t be discounted. The longer this money sits uncollected, the longer you’re unable to use it to pay your staff, your rent, and yourself and may lose it partially or entirely as bad debt.

Tracking your accounts receivable allows you to determine which payers maintain the top balances and the average number of outstanding days per payer, as well as the typical insurance and patient aging.

- Appointments and No-Shows

Patient appointment volume and mix make up the bread and butter of your practice. Therefore, tracking the number of new patients you receive per month and the sources that typically result in referrals can allow you to make future revenue projections and focus on cultivating an increasing number of referrals.

Additionally, it’s vital to realize that just as appointments are what your practice requires to thrive, with no-show rates as high as 30% across the nation and costing your practice an average of $200 each, missed appointments can result in serious financial risk and leave you struggling.

- Charges

One of the easiest ways to ensure that your practice gets paid every dollar you have coming to is to regularly track your charges to identify ones that haven’t been billed. This allows you to recognize revenue that would have otherwise slipped through the cracks so that it can be recovered and continue to fund your operating needs.

Tracking charges also helps you determine which providers in your office generate the most revenue, which services offer the highest return per visit and more, so that you can focus more on your practice areas with the best ROI.

- Net Collections

Unlike your charges, your net collections exclude the write-offs. This number gives you a picture of exactly how much you receive out of the total billed, and the higher the better. It can also help you determine the effectiveness of your practice’s current claims follow-up procedures so that they can be adjusted accordingly.

Ideally, your net collections should fall between 96 and 98% to remain financially viable.

- Claims Follow-up

While your comparison of net collections to charges billed can begin to paint the picture of your claims follow-up, you’ll also want to track denial reports, denial rates and type by the payer and CPT codes and rejection reports.

This information tells you what isn’t being paid so that you can help prevent future denials. The average cost to work on denial is $25.

- Staff overtime

Overtime pay can be a massive burden on your office. And the extra hours themselves can be hard on your staff and even compromise patient care. By monitoring this metric, you’re able to schedule more efficiently to reduce over time, for healthier finances, happier employees, and improved patient safety.

Drilling down to get the most from your data

It’s also critical to leverage a solution that provides a dashboard with drill-down capability for more useful and more robust reports. Drill-down capability ensures that you’re able to view the data from your practice in a detailed and thorough fashion to achieve a granular view.

Reports should be run daily, weekly, and monthly.

Examples of Daily Metrics to track are:

- Charges

- Payments and adjustments

- Balance

- Appointments and no-shows

Weekly tracking should include:

- Underpayments

- Backlogs on collections

- Backlogs of payment postings

Additional Monthly KPIs to review are:

- Accounts receivable

- Net collections with denials and claims follow-ups

- Production per provider

- Overtime

- Payment aging

Controlling your practice’s financial health with KPI dashboards

The medical landscape was already challenging for many medical practices – a situation that was only worsened by the COVID-19 pandemic. Now more than ever, it’s critical to monitor your practice’s financial health so that you can adjust quickly and continue to thrive.

Key Performance Indicators (KPIs) and KPI dashboards with drill-down capability allow you to assess your revenue cycle’s strengths and weaknesses accurately so that you can save time crunching numbers and prioritize your team’s activity and optimize your income. Remember, better financial performance begins with taking control of your data.

16,000 Physician Practices Have Closed Due to the Effects of COVID-19 – South Dakota Association of Healthcare Organizations

COVID-19’s Crushing Effects on Medical Practices, Some of Which Might Not Survive – JAMA

Missed appointments cost the U.S. healthcare system $150B each year – Health Management Technology